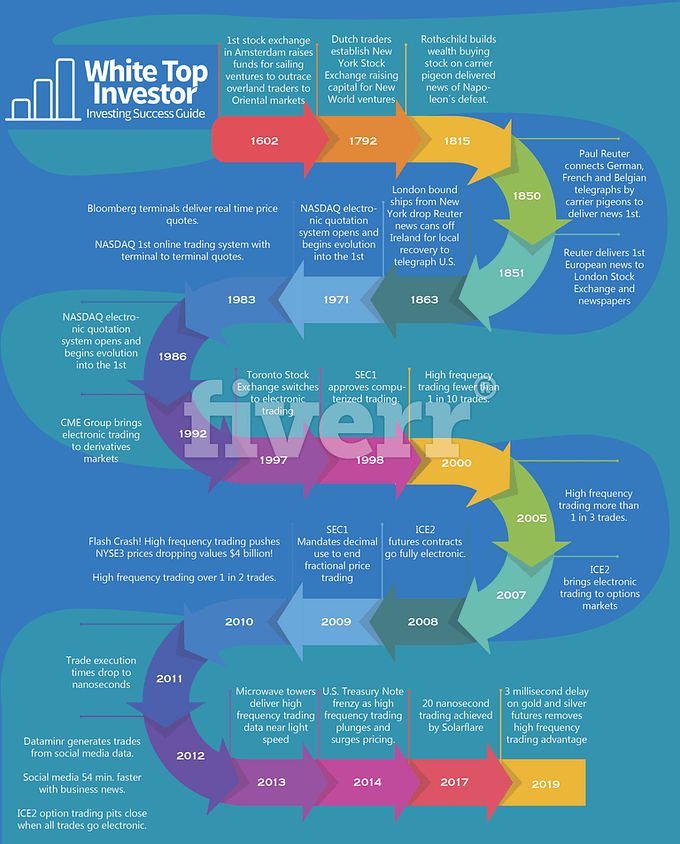

Racing for profits drives high frequency trading forward as powerful allies integrated the technology that changed markets and investing. That race can seem like an inside the game for profit, but large and small investors are all on the outside. Still, investors must bare the costs of HFT being set loose on markets. This is illustrated on the included infographic of stock market technology development that traces the race for profits to the development of HFT.

What you learn from this lesson: Racing for profits drives high frequency trading:

This lesson teaches that racing for profits drives HFT in the never ending market race. It is a race that continues with ever faster technology comes in new waves and surges. That race, illustrated on the infographic, Racing to High Frequency Trading, shows that unending race affects markets and investors. The infographic traces events showing greed driven speed established HFT in markets. And that shows the development of HFT as part of the continual change and evolution in always changing stock markets. For each investor it means we are market and investing constants.

FAQs investors asked about how

racing for profits drives high frequency trading

These questions and answers about how racing for profits drives high frequency trading, have overlapping answers which help investors understand how stock markets, investing, and money-making interrelates.

Where did high frequency trading come from?

High frequency trading adds powerful technology to the unending stock market race for profits. That continues a trend started by the first stock exchange that funded sailing ship ventures to increase the volume and speed of world trade.

High frequency trading is another example of technology affecting markets to impact economies and investors. It combines technology, well-paid allies, passive regulators, and an accommodating business climate in the profit race.

The infographic in the linked lesson illustrates the progression of multiple technologies used by high frequency trading and the market impact.

When did high frequency trading begin?

High frequency trading evolved once electronics and computers infiltrated stock markets.

NASDAQ first introduced electronic trading in 1983, then the Securities and Exchange Commission (SEC) accepted active algorithmic trading technology in 2000. As a result, high frequency trading is here to stay.

The stampede of trades and technology rapidly drove execution times from seconds to billionths of a second! In short order, enormous waves of high-frequency trades clipped investors' open market orders.

As a result, those thin slices of profit from numerous clipped market orders became an established part of stock market trading.

What is the problem with high frequency trading?

Programmed or algorithmic trading can increase market risks. Most significant is the amplification of systemic risks. A system glitch can become a spike or dip in a blink.

The built-in tendency to magnify market volatility combines with interconnected markets to make any slight ripple into a wave that races across markets. The result is more investor uncertainty.

The combination of strategies to create trading fog to mislead investors and regular and belligerent use of misinformation obscures and delays factual stock market information for most investors.

High frequency trading impacts the economy, markets, and investors.

Does high frequency trading impact the economy?

High frequency trading impacts the economy, markets, and investors.

Using increased trading speed and volume, they effectively create secondary markets for anything that trades in volume. Programmed responses produce flash crashes and spikes that amplify risks and ripple through markets to increase uncertainty.

Any program bug can mean a form, function, or result flaw that impacts the economy and increases downturn risk.

While the data and trading misinformation can erode investor confidence and increase capital costs while imposing more charges, the fake market liquidity and manipulation seem beyond the grasp and resources of regulators.

As a result, it produces costs like an unseen tax on investors and markets.

How do you avoid high frequency trading?

Small investors protecting their trade orders avoid the collateral damage of high frequency trading activity. High frequency trading systems seek large institutional trades.

Small investors can protect their orders by setting the price to pay or accept. Never placing an open market order is a small investor advantage over institutional fund managers.

Open market orders are practical for fund managers moving large stock volumes on a specific day or to meet an obligation like a large redemption.

That is the design prey of high-frequency trading systems. But those high frequency trader feasts drive up the net fund costs of the target.

Large fund managers commonly use execution algorithms in the hide-and-seek game to avoid or minimize being that prey.

How did high frequency trading become a stock market feature?

High frequency trading is a significant innovation that became a regular market feature with the help of powerful and well-paid inside allies.

Those allies, including exchange managers, gave high-frequency traders access to investor orders, early trading data, and inside market information. That changed markets to favor high frequency trading.

They became a regular market feature with advantages over all others, from small retail investors to the most significant institutional funds. Investors, aware that these changes expose their market orders, can learn to protect them from these trading predators.

The infographic with this lesson traces the history of those market-changing innovations.

Race to High Frequency Trading infographic

The race for profits that makes high frequency trading has a 400 year track record!

Race to High Frequency Trading Infographic events included:

Race for wealth, power and fortune

Stock market history records the unending race for wealth, power and fortune. That race brought us to HFT where built in advantages now make certain they always win. Never before have tilted markets so favored one type of user over all others. HFT rig markets.

Management driving for revenue discover a cash flow bounty from high frequency trading

On learning that HFT rigs markets, many ask how could it happen? One by one stock market milestones were in place before HFT developed. Knowing of those prior developments helps us understand how HFT could grow to become a dominant stock market force. But is was only when stock exchange managements discovered the cash flow bounty from high frequency trading that the fix was completely in.

That happened by seeking profit by any means was used to justify supporting secret developments that opened markets to HFT. HFT paid exchanges profit producing fees they used to justify market rigging changes. That rigging became entrenched with the changes made for HFT.

To understand how HFT became entrenched requires knowing that background. The background of the greed and speed race, helps us understand how the HFT emerged. Once established HFT quickly grew to become a major stock market force. Knowing how it happened helps us deal with HFT related market risks. With that we become better investors protecting our portfolios from HFT predators.

Stock market history and culture fed high frequency trading

As in all things, a large part of present and future opportunity comes from the past. That also applies to markets. The evolution of investing, trading and raising or placing capital developed over time.

Stock market history shows and reflects our desire for wealth and security. That unfolds as the unending tale of greed chasing opportunity in capital markets. As long as we seek fortune, power and advantage the chase continues. In other words, forever.

Stock markets raised and placed capital

Clever Dutch merchants created stock markets over 400 years ago. Those merchants wanted financing to sail and trade for the riches of the Orient. From a simple Amsterdam beginning, the prime purpose was raising and placing capital. So companies seeking capital to grow had a way to raise it! That was a brilliant innovation! And investors willing to put capital at risk for a return had a way to place it.

Stock exchanges grew as individual operations

The brilliant stock exchange idea grew becoming established in cities around the world. Each stock exchange began as an independent local operation. Like individual businesses anywhere, stock markets had similarities to one another. But they also had distinct or unique features of an individual business.

The two leading U.S. stock markets operated in very different and distinct ways. Electronic matching of orders on NASDAQ began decades ago. In contrast, the New York Stock Exchange (NYSE) featured human to human trading on the floor.

The NYSE: the established home of human trading culture changed

Knowing some of the NYSE history helps us understand changes made that support HFT. NYSE grew to be the Big Daddy of exchanges in the biggest capital market. Players there thought of themselves as the very core at the center of capitalism. NYSE behavior and policy were independent but did influence all markets.

Established in 1792, the NYSE grew to become the world’s largest stock exchange. Generations of strong culture permeated the Big Board. That culture centered on centuries of face to face human trading on the floor.

The trading floor used electronics and computers but the actual trading remained human. That continued even after NASDAQ and most other exchanges moved to electronic trading.

That remained until late 2008. Then the NYSE insistence on human judgement on the trading floor ended. That human influence somewhat subdued HFT. But the pursuit of dollars soon changed everything. All the changes came in response to the 2008 financial crisis.

When push comes to shove, money wins. Racing for profits makes high frequency trading and profits always win! That pushed investors into second place. Later lessons cover and explain these details. They also cover the many changes made as HFT joined the race that keeps changing markets.

Designated market makers had a history of working the NYSE way

The NYSE way of doing things included a determined dedication to human to human trading. Each listed company had human specialists assigned. Those specialists, called Designated Market Makers (DMM), carry inventory of their assigned stock. Using that inventory, the DMM task was to maintain a fair and orderly market. Only the NYSE required an assigned DMM.

To maintain a market, DMM posted both bid and ask prices for a guaranteed number of shares. The buy prices on the orders were usually placed at a little lower price and the ask price to sell, usually gets placed a little higher price. The DMM orders were usually for 1,000 or 10 lots of 100 shares.

They bought or sold when no public orders were available. Doing that ensured investors could always buy or sell. When they did buy or sell, the DMM immediately moved to do the opposite trade. In each case the DMM would sell from inventory or seek an offsetting order in the market. Their profit was the spread, the difference between the buy and sell prices on each trade.

The NYSE considered the DMM task essential to providing market liquidity and stability. The DMM were market shock absorbers supporting growth and stability of the market. DMM worked on the trading floor handling the actual paper used to note the buy and sell orders.

Trading with eight fingers

At the height of trading action human to human exchange floors were noisy. So DMM and other traders communicated using finger signs to overcome the din. Before dollars, pounds, euros or renminbi, investors traded for coins. Gold was in its heyday! Dividing coins into fractions opened trading and began centuries of practice.

In the Spanish Empire centuries ago traders divided doubloons into eights. That way they could signal prices with fingers. Eight fingers signaled portions of coins that became known as pieces of eight. Finger signals allowed price negotiation and trading in eights.

Fast forward to the modern era; the doubloon became a dollar and the eighth became $0.125 or 12 and 1/2 cents. As the smallest trading fraction, an eighth or finger, became the smallest spread. Spreads could be greater, but not less than, an eighth.

In small volumes, differences of an eighth seem insignificant. But in large lots that could mean big total price differences. In time, the number of shares held and traded grew. That made price spreads of an eighth much more significant.

Decimals take all markets in the 21st century

While the world long used decimals and pennies, markets still used vulgar fractions. In a fit of modernization they went to sixteenths! That was in 1997 for the NYSE! More vulgarity! So you know, in this context, vulgar means common. I can't help myself, it is much more fun to call slow to change nonsense vulgar!

The change to sixteenths halved or narrowed the spread to $0.0625 or 6 and a 1/4 cents. The newest trading technology was a half finger sign! Minds dreaming up such things to avoid decimals must indeed be special!

With the passage of time, the holdings of large funds grew. In centuries past a few thousand shares ranked among the largest positions held. In more recent times, large funds hold millions of shares. When trading that amount, a one sixteenth spread exceeds six figure amounts!

Fractions banished as NYSE goes to decimals!

The NYSE began a slow crawl to decimals after the turn of the 21st century. Still holding out for almost a decade of foot dragging, the SEC finally acted. On April 9, 2009 they banned fractions issuing the order to trade in decimals. At last all U.S. markets kicked vulgar fractions into the dustbin of history.

With the holdout gone, decimals were in place across all markets and exchanges. The use of decimals everywhere opened doors. More minds, investors, market users and computer programmers joined the game.

Ever more technology became inevitable in markets as more changes were afoot! For the first time competition for trade orders between exchanges became possible! Racing to HFT became more real.

Technology, regulation and relentless progress

Unrelenting racing for profits that drives HFT, also consolidated stock markets. Major markets across the world come the ownership of a few large groups. Individual independent operations stock markets became parts of multinational global operations. They became money making machines in their own right.

The drive for profits changed cultures and operations of exchanges everywhere. That was as significant as the change from manual trading. Until the 1970’s trading everywhere was manual. It changed with the inevitable arrival of technology. In 1971 NASDAQ began the evolution into becoming the 1st electronic stock market.

Bright minds soon came up with the idea of programming computers to trade. Computers, instructed by algorithms, began to buy and sell baskets of stocks. This milestone began as a simple idea; use computer code to make money trading volumes of stocks.

Algorithms turn technology loose on markets

Small investors trading lots of 100 or less noticed no changes. But it soon became clear to large position traders something changed. Program trading exposed the vulnerability of large position buyers or sellers.

The algorithm battles and predictor trading were underway! When algorithms found a large fund order it set off a sequence of events. First, the program traders snapped up well priced shares from all exchanges. Second, they offered the shares to the fund at higher prices. Funds often had no choice but to pay the price.

Program trading changed markets. On detecting a large order, program trading immediately acted. They bought or had the effect of removing all favorably priced shares. They did that across all exchanges. Rather than large order traders finding and buying shares their costs increased. They could buy but always at a higher price or sell but always at a lower price.

Algorithm vs algorithm or measure and countermeasure

In the trading world, active traders know to back away from large orders. They do that hoping for an advantage. They hope to force owners of large orders to accept less favorable prices.

Both human and program traders feed on large orders, so fund managers needed a response. Large share block trades and technology driven speed developed algorithmic trading further. Funds countered with more technology! The technology battle sped up the race to HFT.

Large funds wrote algorithms to hide their orders. They sliced large orders into many small orders! These child orders get fed into the market over a period of time. It worked! At least at first.

When proven and accepted most observers thought markets benefited from that algorithmic trading. Once permitted for institutional trading, the algorithm wizards were loose on markets! Soon algorithms also worked to discover large orders to trade against them! With computers in the mix, the algorithm battle will continue.

Alternative trading systems and dark pools

To dodge predatory trading, fund managers looked for an alternative trading system (ATS). They wanted ways to trade without exposing orders to predators on an open exchange. In 1998 the SEC accepted ATS opening doors to trading off stock markets.

One alternative included so called dark pools. Dark pools are trading services allowing blocks of large trades at lower costs. Called dark because they offer no information.

Buyers and sellers do not know the number of orders or their size or price! Pricing depends on the light or displayed price stock market quotes for the same stock. Darkness attracts large sellers and buyers who trade without exposure. Large fund use of dark pools has grown into a significant part of global stock trading.

In short order banks and brokers realized they could also set up dark pools. Trading client orders through their own dark pools avoids exchange costs. The significant savings flowed into their pockets!

As always, sharp minds explored further opportunities. The coding wizards soon discovered other possibilities including predatory trading strategies. It was one more step on the way to HFT.

Exchanges faced competition once trade-throughs are out and decimals are in

As noted earlier, once decimal use became universal trade order competition became possible. Finally came the last needed change so that could happen. Trade-through orders were banned in 2005.

Even when better prices were available, orders could fill at suboptimal prices. Suboptimal prices were in the market but not the best price available. Fills at suboptimal prices had buyers paying too much and sellers getting too little.

The SEC required posting of all orders from all exchanges. Everyone could see all posted prices. The combination of decimals and the new Trade-through Rule created new opportunity. The changes made price and order on all exchanges transparent. As a result all exchanges faced real price and order competition.

Milestone foundation for technology core

Stock market milestones covered in this lesson are the foundation used to build HFT. Using ever faster key technologies enabled HFT to develop into a new stock market force. The next lesson, Stock markets and evolving technology make high frequency trading, presents the technology evolutions. That technology evolution is the core powering the HFT systems.

Now You Know:

Racing for profits drives high frequency trading

The lesson taught that racing for profits is the driver of HFT in a race that never ends. The race continues with ever faster technology continuing to come in waves and surges. That race, illustrated on the infographic shown in this lesson, Racing to High Frequency Trading, shows the unending race effects markets and investors. The infographic illustrates events that show greed driven speed helps establish HFT in markets.

That helps us understand the development of HFT is part of unending stock market change. The timeline also shows change and evolution as constants of markets and investing as racing for profits drives high frequency trading as part of capital markets. This shares superior investor knowledge from the Ultimate Guide To Stock Market Investing Success by White Top Investor. Now you also know the following:

You also know the answer to the question:

How did high frequency trading begin and become a stock market feature?

Powerful allies helped HFT become an established stock market feature. Secret technology developments, supporting exchange managements, passive regulators and culture all aligned. They all played a role in making HFT a stock market feature. Racing for profits makes HFT, but powerful allies cemented them in place. HFT emerged from a major wave of technology, stock market and trading innovation. But the allies changed markets to work for HFT. This lesson traces the history of racing for profits to HFT.

In addition you know these lesson takeaways from, Racing for profits drives high frequency trading:

Racing for profits drives high frequency trading and produced many powerful allies. Those allies made changes that installed HFT as an integrated feature of markets. All in on the game, profited, by making HFT a part of markets. But investors were on the outside, baring costs when HFT was set loose on markets. The infograph timeline traces the race for profits to HFT.

As listed on the Racing to high frequency trading infographic:

- 1602 the stock market profit race begins

- 1792 forerunner of NYSE established

- Pigeons and telegraphs carry business news

- 1971 NASDAQ opens electronic quotations

- 1983 NASDAQ 1st electronic trade

- 1986 London Stock Exchange goes electronic

- 1998 computerized trading accepted

- 2000 HFT grows to 1 : 10 trades

- 2005 HFT 1 : 3 trades

- 2010 Flash Crash by HFT drops $4 billion from NYSE value

- 2011 trade executions reach billions of a second

- Algorithms and technology dominate markets, investing and trading

Learn from lessons related to: Racing for profits drives high frequency trading

Mortal investors see immortal debt

Optimism and unrealistic investor minds

FED begins Quantitative Tightening

Comments and questions on, Racing for profits drives high frequency trading, welcome here.

Ask questions, email me at [email protected].

And subscribe for free to get White Top Investor lessons in your inbox!

Learn to make money work for you and know how investors think, feel and act. Begin to build your Investor Mind.

White Top Investor lessons, website layout and organization: click here.

Make money work for you

The lesson, Racing for profits drives high frequency trading, shares superior investor knowledge. By knowing you become a more comfortable and confident investor. That is how White Top Investor lessons help you learn investing one step at a time. And each lesson can be used at your own pace to build and master financial security and independence. White top Investor never sells or shares our email list. Learn more.

High frequency trading explained, lesson links:

Introducing high frequency trading explained Lesson 1

Racing for profits drives high frequency trading Lesson 2

Markets and technology built HFT Lesson 3

Technology powers high frequency trading Lesson 4

High frequency trading secrets exposed! Lesson 5

Laws and ethics beat investors Lesson 6

Market management burns investors Lesson 7

High frequency trader 3-Way ambush Lesson 8

Fair and foul high frequency trading Lesson 9

High frequency trading strategies, risks and regulations Lesson 10

Misinformation myths of high frequency trading Lesson 11

Markets technology and laws respond to high frequency trading Lesson 12

Investors deal with high frequency trading Lesson 13

59 FAQ about high frequency trading Lesson 14

Next lesson, course 510 lesson 3:

Markets and technology built HFT

Share:

Racing for profits drives high frequency trading

Buttons below let you share this lesson with family and friends!

Now, it's your turn! Apply what you learned in lesson, Racing for profits drives high frequency trading!

To begin applying your new knowledge, go at your own pace. Take the time you need to understand the lesson helps you master it. Then apply what you have learned as another step on your way of developing into a superior investor. Have a prosperous day!

Image courtesy Unsplash.com

Copyright © 2011-23 Bryan Kelly

WhiteTopInvestor.com