9 Short seller facts align before short sellers target a company. That means, experienced, knowledgeable short sellers know when the stock market and company facts favor a short play. They know the market, company, and sector facts as well as the timing, costs, price, and rules that must be played with the right short strategy. All that makes short selling a complicated strategy. Therefore it is a strategy for experienced, knowledgeable players.

What you learn:

The keys to short selling success are an alignment of nine facts and critical short selling skills. Those facts and skills are discussed in this lesson. You can learn how the market, company and sector facts must be in time with the costs and price, meet the rules with the right strategy. Only then, when the short selling stars align, do experienced short sellers move on their selected target companies. The lesson covers the following:

Frequently Asked Questions about

9 Short seller facts align

What are the keys to short selling?

Short selling is a complex trading strategy with many moving parts that depend on great timing and excellent execution.

The timing must consider crucial factors that include market and company facts, the economic sectors, the market response, costs, stock prices, the market rules, and the strategy.

As a result, short selling is intricate and challenging to learn and master. However, those that short sell the right stock with good timing and sharp execution can produce significant profits.

It is worth noting that short selling can test your character and psychological fortitude! It is not easy; proceed with caution!

Is there a time limit for short selling?

There is no time limit for short-selling in absolute terms. However, this hands-on strategy has the practical limitation imposed by running costs, making timing a significant factor for profitable short-selling.

When the timing is right, experienced short sellers sell their target shares at a high price, which ignites the running cost fuse.

After selling at high prices, short sellers must drive prices down and buy back to cover to maximize profits.

All investors can improve their market and investment knowledge by understanding the basics of short-selling facts, timing, and judgment.

Is short selling a hands-on strategy?

Short selling is a very hands-on strategy for experienced investors with good knowledge of markets and trading. And, the best of these well-informed and current traders have excellent research skills and a broad information network. Their knowledge includes the facts, timing, and good judgment needed to successfully short stocks. Getting that timing right is the most critical short seller skill. So, when circumstances are right, experienced short sellers can quickly move to attack their selected target company. Then, hands-on, they closely manage the process of selling short, broadcast their research, promote the short case, control costs, and cover for their optimum return. All investors that understand the process, get a deeper understanding of stock markets and investing.

What are the steps to short selling profits?

The basic short selling steps are simple.

1. Borrow stock.

2. Sell at higher prices.

3. Once the price falls, buy it back.

4. Repay the borrowed stock.

5. Pocket the difference. Done!

But there is more!

Successful short sellers also know and understand the importance of other factors. Using the following well, can produce the most short selling profits.

1. Short selling is intense, short-term, hands-on action.

2. Overvalued shares are not enough, good short targets have multiple issues.

3. Each stock has a pattern and range of behavior the short seller must know.

4. Short sellers know the rules and market behavior where the stock trades.

5. Most importantly, short sellers know how to get the timing and execution right.

Short sellers need more

than knowledge and timing

Successful established short sellers have a process and the discipline to research, find and prepare their short selling attack. That process ensures that they sell short only after being convinced that the facts and odds have lined up in their favor. To do that, they consider a diverse number of factors. The following covers 9 major short selling factors.

9 Major short selling factors:

- 1market facts

- 2company facts

- 3sector facts

- 4market response

- 5timing

- 6costs

- 7stock price

- 8short rules

- 9short strategies

Experienced short sellers bring a wide field of vision and experience to the market. That means they are not beginners but traders with a track record of successful stock trading. Only after they carefully research, examine and consider each influencing factor do they consider selling short.

To find their most favorable short selling situations and targets, they do careful research. As well, they look at the combined effects of all factors before taking any short selling action.

Only after the odds and facts have lined up in their favor, will they take action and sell a stock short. They do not ever act in anticipation but only act n facts they believe to be true.

Two major short selling factors:

Although the 9 factors must all align for a great short sale, the most important among the factors are the market and company facts.

1. Market facts used by short sellers

The market itself and the overall investment climate play a role in any shorting strategy. For example, in strongly running bull markets, profitable shorts are less common. As a result, short sales generally work best in weak or falling markets.

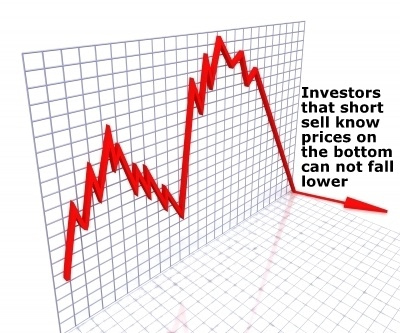

Eventually, every down-trending market reaches the bottom. At market bottoms, when most investors have negative feelings, shorting can be both difficult and dangerous. So, when the bottom has been reached the only way is up. That means the time to short has passed making selling short at market bottoms a form of financial suicide.

Short sellers are cautious in bull markets

In strongly rising bull markets shorting can also be very challenging. Even when the stock of a company trades at incredibly high prices, betting that it will soon fall can be very risky. In such situations, being wrong gets very expensive!

Markets are not logical. In fact, the market can assign insanely high stock valuations for a very long time. Sometimes that can be for years! That is why there are numerous examples of companies that are not making money or with little or no revenue, that trade at high stock market values.

In other cases there are real growth stories with insanely high stock prices! That does not matter. Unless there are other serious factual reasons to short such a stock, never consider that a good short. Fortunes have been lost shorting overvalued stocks of strongly growing companies what are developing into real business success stories.

In time, reality does eventually catch up with every stock. However, that can take a very long time. Short sellers getting that timing wrong will be poorer. Even if the market eventually shows the stock does corrects to a rational level. Being right but poor is not a good short selling strategy!

Shorting the stock of such companies can seem very logical. However, the market is not logical. It is the market and can remain irrational long after a short seller becomes insolvent! Shorting, especially in a strong running bull market, can be a very costly mistake. Especially when the flaw or weakness of the shorted company is only a wildly overvalued stock.

Although, there are examples of short sales working very well in virtually any market. In most cases, the market factor generally keeps short sellers quietest in both deeply depressed and very strong bull market runs.

2. Company facts short sellers need:

By far, the most important market factor for short sellers is knowing the business fundamentals of the target company itself. Those company fundamentals may hold negative information from operations, finances or the market. Being first to uncover any significant change, before it is priced into the market, can ensure a good short.

That can be as close to a sure thing as any short seller can get. But, w\Without a doubt, even in the most unfavorable market conditions, a very profitable short sale can happen when the fundamentals are negative.

Knowing, surmising, or suspecting that a company will soon have to release very bad financial information can be a very good opportunity to sell short. As a result or very bad operating results, even a strong bull market will not protect a company with very bad fundamental operating or financial results.

Good news for the short seller is bad news for the company. And that bad news usually comes in the form of poor operating results, reports of management misbehavior or a negative market outlook.

Or significant financing troubles can also sink the value of a stock. In such cases, shorts have to move fast because the stock repricing can quickly happen. But when the short seller has facts or beliefs that they have uncovered information that will hurt the value of a stock. They have to believe those facts will show the shares are significantly overvalued. If so, the short selling begins.

When time permits, the short selling is done quietly, at least at first, so buyers are not spooked. After all, they need someone to buy the overvalued shares that they have borrowed.

However, simply taking a short position does not guarantee the short seller a profit. To profit, the short seller must be right as well as get the desired and timely negative market reaction to the bad news. Get that timing wrong and being “right” can make the short selling much poorer. After all, if the market does not agree with the short evaluation, the stock price is not going to move very much.

In most cases, short sellers expect the market to react negatively as soon as the bad news or revealed information, gets released. However, that does not always happen. In cases where the expected bad news does not happen, little or nothing happens. But, get it right and a significant share price drop can happen in seconds or minutes, but can take hours, or days.

However, that does not always happen. In those cases, short sellers can tear their hair out in frustration when the anticipated reaction does not happen. It may be so, even when the bad news the short seller expected gets released.

At times market can seem to shrug at any news and just carry on. As noted above, the market is not rational. It is simply the market; the result of collective human behavior that is often not rational or logical.

Timing and aligning other factors

When the market and factors of a potential short target company align, short sellers begin paying close attention. Of the other seven factors, the sector facts often fall in line with the company and market moves, leaving the next three other closely tied factors. These related three, timing, costs, and price, often favorably align as the market makes favorable moves.

The next important factor, compliance with the rules is a given in all short plays. That leaves the choice of strategy as the last decision that must fall in place. While there are countless different strategies, most short sales are plays on either, a downtrend pullback, a trading range movement, or on a stock in an active decline.

Timing and risks challenge shorts

No matter what strategy is used in any market, short selling presents the seller with a continuous management challenge. Timing and risk management are locked at the top of that list. The successful management of timing and risks presents challenges in any short selling play.

Question Answered!

Answering the question, what are the keys to short selling? Knowing that the 9 keys to short selling must align, helps investors learn how the market, company, and sector facts align in time with the costs and price, meet the rules, and play an appropriate strategy. When the short stars align, experienced short sellers, can successfully attack targeted companies.

Key takeaways,

9 Short seller facts align:

As covered in the lesson, short sellers seek to align 9 short seller facts when selecting a short target. And we know the best short sellers are skillful at both timing and executing their short and covering trades at the lowest possible cost. Importantly, they make sure the market, company, and sector facts, timing, costs, price, and rules line up with their strategy. These experienced, knowledgeable players also manage the following complications well.

Other lessons related to:

9 Short seller facts align

Thinking investors grow wealth

Sorting US & Canadian stock markets

Financial statement numbers exposed

Investor homework grows profits

Dangerous dividend warning signs

Financial statement numbers exposed

Market patterns repeat repeat repeat

Comments and questions welcome

Email me at [email protected].

Subscribe free and get White Top Investor lessons in your inbox!

Make money work for you by knowing how investors think, feel and act. Learn here The Investor Mind.

White Top Investor lessons, website layout, and organization: click here.

Make money work for you

Become a knowledgeable, comfortable, and confident investor using White Top Investor lessons. Learn investing one small step at a time at your own pace to become the master of your financial security and independence. White Top Investor never sells or shares our email list. Learn more.

Lesson links to:

Short story shorting stocks:

Short selling stock explained Lesson 1

Short selling improves markets Lesson 2

Short selling improves companies Lesson 3

9 Short seller facts align Lesson 4

Making money selling short Lesson 5

Shorting stocks has risks Lesson 6

Who’s selling your stock? Lesson 7

Short seller skill sophistication knowledge Lesson 8

Short seller cost control Lesson 9

Short selling has rules Lesson 10

Next lesson 5: Making money selling short

Making money selling short Lesson 5

Share:

Making money selling short

Buttons below let you share this lesson with family and friends!

Images courtesy FreeDigitalPhotos.net

Lesson code 505.04

Copyright © 2011-24 Bryan Kelly

WhiteTopInvestor.com