Search Results for: economy

High frequency trading secrets exposed!

… with a link to a Churchill Club event. The Churchill Club is a Silicon Valley not-for-profit public benefit organization. Their purpose is to encourage innovation, economic growth and societal benefit. They put on events that ignite important conversations.

In January, 2016 they sponsored an HFT related event. Check this entertaining and informative conversation …

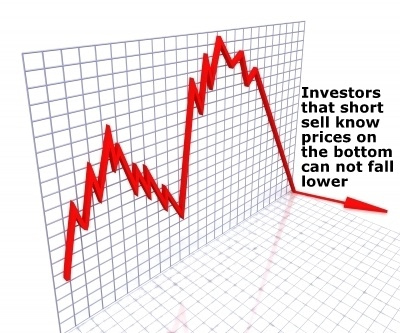

9 Short seller facts align

… trading strategy with many moving parts that depend on great timing and excellent execution. The timing must consider crucial factors that include market and company facts, the economic sectors, the market response, costs, stock prices, the market rules, and the strategy. As a result, short selling is intricate and challenging to learn and master. However …

Read MoreIntroduction to short story shorting stocks

… they are often right when pointing out weaknesses in company operations. Shorts do expose lies, cheating, corruption, and management belligerence or abusive business practices.

Markets, companies, and economies are better when mismanagement or missed opportunity gets exposed. In that way, shorts do have an overall positive effect on markets. The how and why that can …

FAQs about No-Worry Investor advantages and choices

… business owners,

4. Limited diversification concentrates investment power,

5. Before investing, do your research,

6. Invest for the long-term, do not trade in and out,

7. Economic and business fundamentals matter, not the stock market,

8. Investing psychology affects markets; facts can manage emotions,

9. Growth and bottom lines matter, not forecasts,

10. Careful …

Market risks from headline news

… the share and market price fluctuations.

What kind of news affects stock markets?

News, from natural disasters to local events, affect stock markets. But routine impacts are economic or business news, such as interest rates, inflation, and GDP. And politics influence markets, including elections, policy changes, and international relations.

Naturally, company news of earnings, mergers …

Investors manage mortal and immortal debt

… all the financing come from? The fixed income market floats on the collective and seemingly endless ocean of immortal debt. That is the bond market. Investors and lenders place many trillions of dollars to finance bonds. Most of the funding contributes to the operation and growth of today’s governments and modern economies. The bond

Read MoreMuddled minds harm investors

… have been proven nutty ideas and bad research! Your confusion keeps élite company with some high status people and ideas!

Solution: An old academic joke…any two economists together will give you three opinions. On the other hand I could be wrong! Learning and thinking are the solutions for us.

We can work together to …

Investors retirement saving dangers

… expenses, and the financial consequences of losing a spouse.Preparing a plan that addresses these risks helps ensure a secure and comfortable retirement.

What retirement planning mistakes are common?

The most common mistake is not planning for retirement, which can compromise your financial future. A well-thought-out retirement plan considers emotional, physical, and economic

Investing confidence, taxes and learning

At times choppy market behavior and volatility can worry a new investor. Watching three big factors can reassure an investor and give investing confidence.

Investing confidence

Three factors give investing confidence markets are going higher:

First, economic growth trends are up and continue to improve,

Second, tapering is many months off and,

Third, Fed tightening …

Using watch list holds

… a strength but offers little or no growth. I resist changing these holdings until convinced there is a weak or under performer. They get sold.

At times economic events or developments change the outlook and may need adjustments to positions and sizes. These accounts undergo fewer changes than the growth portfolios that I manage.

Managing …