Search Results for: portfolio management

Investors deal with high frequency trading

… Without doubt the greatest small investor advantage is the possibility of operating at very low cost. That means small investors have the option of avoiding high money management fees. Unfortunately, high money management fees take half and more of the gains made by investor capital. The financial service industry stoutly resist making any meaningful changes …

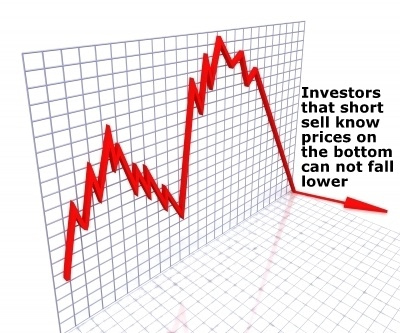

Read More9 Short seller facts align

… the seller with a continuous management challenge. Timing and risk management are locked at the top of that list. The successful management of timing and risks presents challenges in any short selling play.

Question Answered!

Answering the question, what are the keys to short selling? Knowing that the 9 keys to short selling must …

Short selling improves companies

… market action. That helps improve your investment skills, which improves your investing opportunities and performance.

Lesson takeaways, Short selling improves companies:

Short selling improves companies by making management accountable and forcing checks on priorities, strategies and analysis to improve operations and increase shareholder value.

Corrections with 10% price drops happen regularly.

Dips and corrections generate …

Short selling improves markets

… Short selling improves markets:

Short selling improves stock markets with liquidity, price discovery and activity that can also improve some shareholder values. Short seller pressure has made managements more accountable as well as sensitive to public, employee and shareholder issues. That pressure has made management of some companies more receptive to contrarian views or analytics …

How To Make the Right Long-Term Investment Choices for Success

How To Make the Right Long-Term Investment Choices for Success is a comprehensive guide to help investors make important portfolio-building decisions that ensure long-term success. It explores successful investment strategies and emphasizes the importance of making informed choices among the many investment options. The lesson is suitable for beginners and experienced investors …

Read More3 Distinct investing approaches

… risk means more downside.

Seeking more or higher returns means having more time and more knowledge to invest. Seeking aggressive investment returns also takes much more account management time.

Avoid spilling money – walk before you run!

When you begin investing, begin with a conservative approach. Investing well takes a lifetime. Think lifelong to be a …

Investor Mind: Understanding the No-Worry Investor market-mind

… be getting help from a financial advisor who does everything for you.

If you seek professional help, as your knowledge and experience grow, you can make investment management changes and choices should you wish to take complete control of your investment decisions.

Improved investment returns are a benefit of increased investment knowledge. That positive outcome …

Mastering The Most Powerful Investing Factors: Time and Knowledge

… period. It requires precise market timing. That is challenging although it can be appealing to investors who prefer a more active trading approach. Regular monitoring, reviews, and portfolio adjustments, possibly daily but typically monthly, or quarterly, in response to changes, ensure investments remain aligned with momentum trends.

4 Risk Management

Higher risk is the major …

Exotic ETFs blow-up portfolios

… to modulate market forces but to actually mirror the daily tracked price movement.

The rebalancing happens when supply (sellers) and demand (buyers) becomes unbalanced. That is “fund management speak” meaning the price movement, based solely on buyer and seller supply and demand pressure, is less or greater than the price change in the tracked item …

3 Big investing choices

… to investing. Although mutual funds 1 of 3 big investment choices, remains true. But technology opens many alternative doors.

For example, digital communications leave obsolete mutual fund management structures in their dust. Technology erases the need for costly outdated bureaucracy. Alternate financial products now outperform mutual funds by a huge cost difference.

For this reason …