Search Results for: Stocks

Who’s selling your stock?

… belongs to the broker.Where are my stocks held?A brokerage account stores the stocks you buy. You can use this account to buy, sell, and hold stocks, bonds, mutual funds, and exchange-traded funds (ETFs). You access your stock information through the broker’s online platform or app.When you buy stocks, the brokerage …

Read More9 Short seller facts align

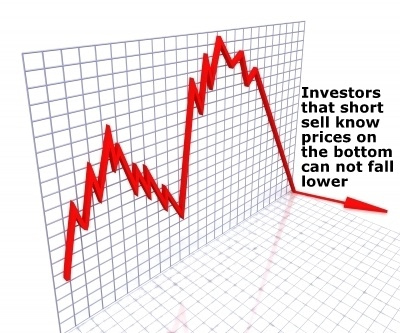

… well-informed and current traders have excellent research skills and a broad information network. Their knowledge includes the facts, timing, and good judgment needed to successfully short stocks. Getting that timing right is the most critical short seller skill. So, when circumstances are right, experienced short sellers can quickly move to attack their selected target …

Read MoreRacing for profits drives high frequency trading

… electronic stock market.

Bright minds soon came up with the idea of programming computers to trade. Computers, instructed by algorithms, began to buy and sell baskets of stocks. This milestone began as a simple idea; use computer code to make money trading volumes of stocks.

Algorithms turn technology loose on markets

Small investors trading lots …

FAQs Profit Hunting Investors Know: Market Risks And Portfolio Protection

… The Lesson, Dangerous dividend warning signs.

What is a good dividend yield?

Investors use two dividend benchmarks when evaluating yields: the average yield of all dividend-paying stocks and the ten-year U.S. Treasury note. Any yields below that standard are poor; above 2% is fair, but 10% plus is excessive. While 4-6 …

No-Worry Investor FAQs: How to Make Smart and Confident Choices

… to related lessons for further details, discussions, and additional FAQs, ensuring that investors can build a solid foundation of knowledge. Topics range from essential investment choices like stocks, bonds, and ETFs to more advanced strategies, such as managing risk and knowing when to sell. In addition, the guide emphasizes the importance of research, diversification, and …

Read MoreShort selling improves companies

… answers which help investors understand how stock markets, investing, and money-making interrelates.

Does short selling hurt a company?

Short sellers seek to profit by finding overvalued stocks of weak or vulnerable companies.But not all overvalued companies are poorly run, so savvy traders don’t attack well-run companies. Instead, the best short targets …

Short selling improves markets

… efficient, healthy, and functional. It increases market participation and generates valuable data while improving price efficiency, volume, and liquidity, including during market downturns.When applied to individual stocks, short-selling helps to highlight governance or operational issues and identify overvalued equities. That attracts media and analyst attention, which increases awareness and information sharing among investors …

Read MoreHow To Make the Right Long-Term Investment Choices for Success

… money-making interrelate. The following generalized answers can vary depending on individual circumstances and priorities.

What are the investment choices?

Primarily, the big three investment choices are stocks, bonds, and cash. Additionally, mutual funds and exchange-traded funds (ETFs) are popular among investors.

Beyond these, real estate, precious metals, other commodities, and private equity are …

Winston Churchill said crisis brings opportunity

… ourselves to win.

Do your homework on any new stock positions you are considering and wait to buy when the market moves down. Think of it as stocks are going on sale! As stock market opportunities unfold politicians fiddle but that is normal. Just do your homework and be ready to load up!

With homework …

Introduction to Money Strategies Planning & Managing Wealth

… in each lesson. With that, you know the material and subjects covered in the course telling you what to expect.Course topic big picture highlightsFirst, why growth stocks attract both investors and traderThe 8 big money matterChange can be influenced and controlledBecause time is money, especially time in the marketDips and corrections deliver opportunitiesChoosing to …

Read More