Search Results for: trading

Portfolio Optimization: The Importance of Stock Holding Size

… value.

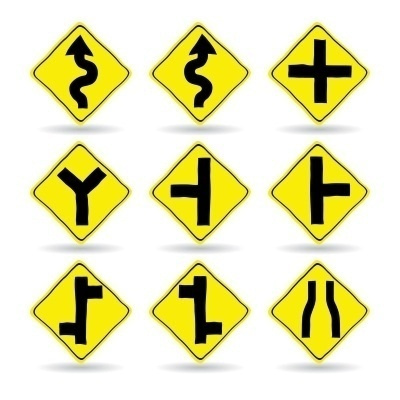

Position size and number are related.

Size and number of positions vary by individual market approach.

An investing income approach often has about 20 positions.

A trading approach often carries fewer, but larger positions.

A speculator’s approach often has very few or many more positions.

Make the position size large enough so growth …

Change Is The Investment Growth Catalyst That Moves Markets

… revenues, earnings, or profits, Second, technicals like momentum or price patterns displayed by charts, Third, the tick-by-tick display of traders’ and investors’ feelings that algorithmic trading can magnify. Those forces may interact or move independently. Sometimes, they seemingly have no logic and can influence, impact, counter, or reflect one another or not! Yet …

Read MoreCharts Unlock Market Patterns: Finding More Money Making Opportunities

… focuses on price movements to predict future movements’ direction, magnitude, and probability. Investors and traders can use chart reading knowledge and skills to find helpful investment or trading information quickly.

How do investors use stock market charts?

Stock and market charts are invaluable guides for investors who can read these money maps. Investors and traders …

Media Exposes Financial Advisor Incompetence: How to Protect Your Wealth

… 09

3 Yeses or no investment Lesson 290.10

Investing can be fun, interesting and slow Lesson 290.11

Warren Buffett explains gold Lesson 290.12

Stock trading halts explained Lesson 290.13

FAQ about money making investment choices Lesson 290.14

FAQ about financial and investment advisors Lesson 290.15

Next lesson: Small investors …

Eliminate Market Noise to Find The Best Investment Opportunities

… stock market noise and use 4 market indicators to cut through that noise and get reliable investment signals. As well, it identifies the differences between investing and trading signals. Additionally, it discusses how, why, and when those key stock market signals matter, and when and why other data does not matter. Ultimately, what you learn …

Read MoreThese Three Big Money Makers Can Work For You

… learn and do, while trading takes more time, experience, and knowledge for the best outcomes. As for speculating, the most consistent results come from those with proven trading records and extensive experience who put in the most time and effort.Income investing thrives in all market conditions, trading flourishes in favorable markets, and speculation works …

Read MoreStock Scam FAQs Answered: How to Detect, Avoid, and Beat Scammers

… in newsletters, social media, and phone calls to pump stock prices, sell their shares for a profit, and leave investors with worthless stock.Other scams include insider trading and short and distort schemes that illegally buy and sell shares on non-public information to profit, avoid loss, or use false information to drive prices down …

Read MoreThinking Investors Grow Money: Proven Strategies to Grow Your Wealth

… However, traders produce mediocre results when markets are quiet or down.

Short sellers profit from falling stock prices, targeting overpriced shares in any market condition and aggressively trading during downturns.

Why do investors prefer growth stocks?

Investors like profits, and growth stocks can be highly profitable. Particularly in buoyant markets, growth stocks can go from …

How to Avoid Scams Using the Best Stock Scam Tips

… unsolicited contacts.7. Learn about markets, investments, and investing.8. Insist on audited financial statements for any investment.9. Don’t follow the herd or succumb to FOMO (Fear Of Missing Out).10. Learn the difference between investing, trading, and speculation.11. Manage emotions with the emotional intelligence of a wise investor.12. Use …

Read MoreStock Scam Awareness Defense: How to Keep Your Money Safe

… in newsletters, social media, and phone calls to pump stock prices, sell their shares for a profit, and leave investors with worthless stock.Other scams include insider trading and short and distort schemes that illegally buy and sell shares on non-public information to profit, avoid loss, or use false information to drive prices down …

Read More