Search Results for: Economy

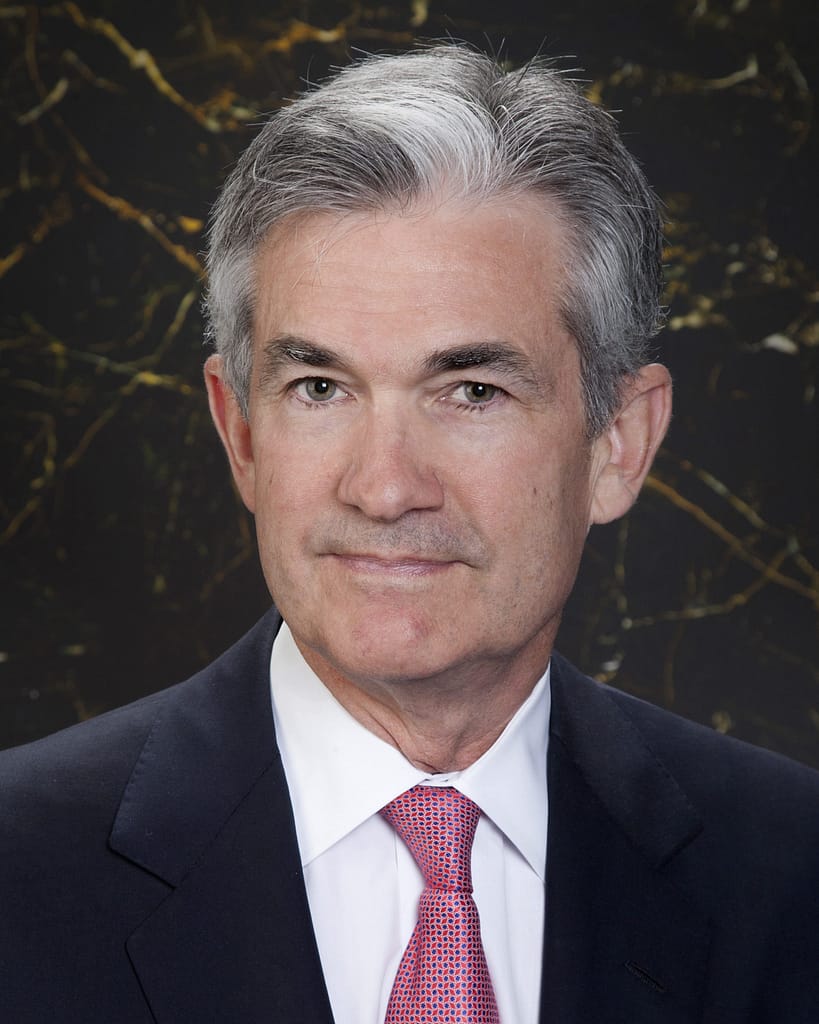

The most powerful civil servant!

… with the job of ensuring economic prosperity.

The FED Chair leads the American monetary policy process and pushes the money-creating button for the world’s largest economy! That unmatched economic and financial power gives the FED Chair top rank among civil servants and sets the monetary and economic tone that investors track and major …

Contents and Layout

… options and warrants

Diversification – an essential portfolio strategy

E

Economy – includes the following

Auto Sales – vehicles, 1 of 3 key trackers

Debt – wealth destroying monster

Employment – jobs, 1 of 3 key trackers

House Sales – real estate, 1 of 3 key trackers

Equities – stocks and shares

ETF – Exchange Traded Funds

Exchanged Traded Funds – ETFs offer …

White Top Investor Links Interesting And Useful Sites

… Income Earner

Dividend Earner dividend focused blog Dividend Earner

Million Dollar Journey, a Canadian story Million Dollar Journey

Take control of your personal finances Modest Money

Outstanding financial blogs

A wide-ranging forecast free financial blog Abnormal Returns

A blog about financial markets and the economy The Reformed Broker

Start here to know the Investor

Debt Management Secrets Exposed: Profits From Mortal and Immortal Debt

… growth.

Business Loans

Purpose: Starting or expanding a business.

Benefits: Business loans help entrepreneurs start and grow their businesses. Successful businesses have returns that surpass the loan cost. Consequently, these businesses generate substantial income. This income adds to individual wealth and grows the economy. Therefore, business loans are vital. They enable businesses to expand …

FED Market Direction Signals: How to Interpret and Profit

… markets! The FED created and forced vast sums of money into the market to support economic activity until the commercial and private lenders returned. Credit and the economy survived, preventing a depression. However, as commercial lenders return, the FED must reduce a balance sheet ballooned during the economic rescue mission.

Does the FED control the …

Mastering The Most Powerful Investing Factors: Time and Knowledge

… from the rise in share prices. As always, there are exceptions to this generalization. The share price of these companies can and do rise with the general economy. That is often at a pace well behind the prices of the market leading shares.

There are many happy exceptions. Companies that can and do pay dividends …

2 Debt 1ST Step to Wealth - Debt Control

… Every year car dealers have to move a fleet of low mileage lease returns. There are many good deals among these well maintained vehicles. Choices range from economy to extreme luxury.

Just don’t use the price break of a used car to blow your wealth building plan. Shifting your purchase to a higher end …

FED begins Quantitative Tightening grinding out a tapering decade

… the FED begins Quantitative Tightening (QT). The QT program unwinds the effects of the previous decade of QE. QE poured an ocean of stimulus funding into the economy following the 2008 financial crisis. As a result, those trillions of dollars ballooned the FED balance sheet even while markets and the economy recovered and grew. That …

Read MoreNo-Worry Investors Manage Emotions for Better Returns in Volatile Markets

… and maintaining discipline throughout all markets.

They stay on the plan to avoid the easy mistake of taking excessive risks, especially during the euphoria of a strong economy during bull markets.

On the other hand, they stay invested during volatile markets or a downturn. Reacting to short-term market fluctuations by selling can jeopardize long …

Check market direction trends

… certainly don’t start a renovation or consider buying a larger house unless we think we can afford it.

Our behavior and that of our family, friends and neighbors cascades through the community and economy. Keeping aware of any changes in such behavior puts us in great position to move as required when the stock