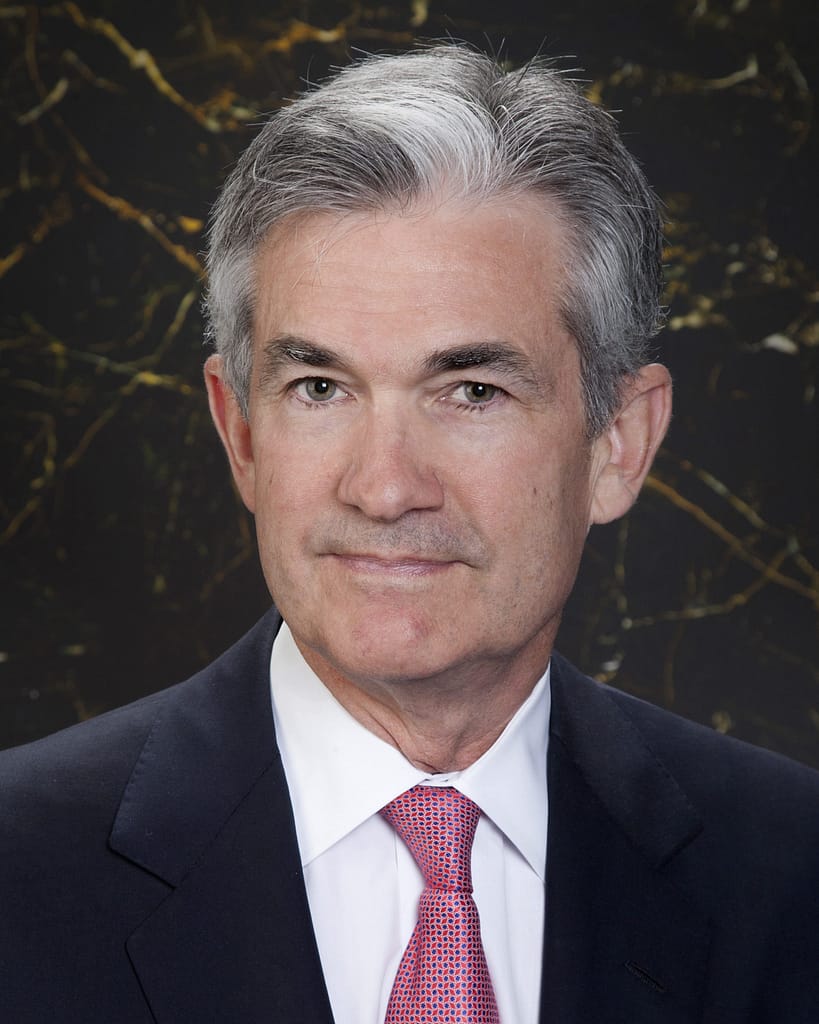

Search Results for: Central Banks

The most powerful civil servant!

… Learn the unique economic and financial role of the FED and Chair in the U.S. FED activity and words of the Chair influences economic, financial, and central bank policy and actions taken around the world. Links at the end of this lesson will guide you to related lessons to learn more.

FAQ investors ask …

Change Is The Investment Growth Catalyst That Moves Markets

… healthy economic growth, but high inflation can erode purchasing power and profits, leading to market declines. Similarly, low inflation or deflation can also be problematic.

Interest Rates:

Central banks, like the Federal Reserve, set interest rates. Lower rates make borrowing cheaper, stimulating investment and spending and driving the market up. On the other hand, higher …

Amazing Story of the Man Who Cancelled an Economic Depression

… grips the market, buyers vanish, credit freezes, and financial activity halts. Short-selling can worsen situations where there are already looming depressive or inflationary pressures.

Although governments, central banks, and organizations like the International Monetary Fund can stabilize markets, a financial crisis can suddenly or gradually escalate.

What is the business cycle?

The business cycle …

FED Used Massive, Powerful Financial Stimulation to Obstruct A Depression

… public policy response ended the crisis. Following are questions investors asked and the needed answers.

What is Quantitative Easing?

Quantitative Easing (QE) is a unique and powerful central bank monetary tool to stimulate economic growth. The usual stimulation, purchasing short-term Treasuries, becomes ineffective when interest rates are near-zero. Then, central banks can turn …

When Headlines Impact Markets: How to Protect Your Portfolio

… indices.

Central Bank Announcements:

Decisions on interest rates, monetary policy changes, and other announcements from central banks (like the Federal Reserve in the U.S.) can affect investor sentiment and market trends.

Geopolitical Events:

Political instability, elections, international conflicts, trade agreements, and sanctions can create market uncertainty and volatility.

Natural Disasters and Pandemics:

Earthquakes …

Contents and Layout

… time commitment of investors

Blog – all posts listed in reverse chronological order

Bonds – debt obligations

C

Central Banks – monetary policy and currency base for government and commercial banks

Bank of Canada – pending

Bank of England – pending

Bank of Japan – pending

Federal Reserve Bank- America calls the banking tune

European Central Bank – pending

Conference Calls – hot …

Trillions that stimulate the Japanese economy show our economic future!

… liquidity injections, fundamental government policy changes and clever debt management may combine into as a new economic model.

This lesson 6 of the Investors, The FED and Central Banks Banks course 145 gives detailed answers to the questions, what caused Japan’s economic crisis and how did Japan get past the lost decade? Links at …

4 Market direction drivers

… the U.S. FED fund rate is key. All other central banks and economies are directly and substantially affected by it. So no matter where you live this one is the one key rate. All other national and regional rates will be directly affected if not actually determined by it. That will hold true …

Read MoreBank Innovations and Credit: Leading the Way to Economic Growth

… or Bank of Canada, Bank of England, and so on, the specific mandate of each vary.

However, overall reserve banking serves as the base of all their mandates. That reserve structure or central bank serves as the bank for the banks. At least in theory, the central banks hold the reserves of the banks …

FED Market Direction Signals: How to Interpret and Profit

… activities can happen, which attracts law enforcement action.

How did the FED make credit work during the financial crisis?

During the 2008 financial crisis, the FED demonstrated central bank power by creating more credit and dropping interest rates to zero. They also forced funds into banks to add liquidity and supported credit markets by buying …