Search Results for: series

Venture Exchange creates opportunities

… country, with relatively few people and vast amounts of natural resources.

Investors look beyond The Canadian Shield

This post is Part 6 of the White Top View Series, Stock Markets, basic discussions of the American and Canadian stock markets. Links to all parts of the series are at the end of this post.

Investment opportunity …

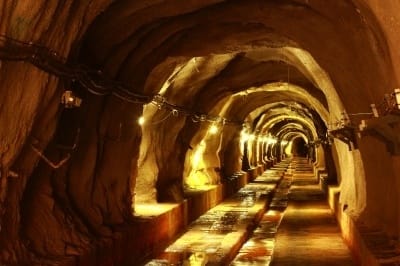

Bedrock of Toronto Stock Market

… broad range of business. Still today, the materials or mining sector remains a very significant part of the Canadian stock market and economy.

Next discussion in this series we turn our attention turns to the background of the Venture Exchange.

Share: Bedrock of Toronto Stock Exchange

Buttons at the bottom of the page let you …

Canada's one trading place

… with both growth, development and resource venture funding. Those growing numbers of resource plays promise very interesting times ahead!

Next White Top View blog post in this series we dig deeper to understand how Canada developed a unique market mix.

Share: Canada’s one trading place

Buttons at the bottom of the page let you …

Exotic ETFs blow-up portfolios

… 27, 2013 issue of The Globe and Mail and gives excellent coverage of the ETF universe, “ETFs: Everything you ever wanted to know”.

Next post in this series we begin to discuss my favorite, stocks! Stocks or equities are the 3rd of the big three market choices. This is where I love to rock & roll …

ETF Revolution changes investing

… must acknowledge that there are many other developments, some of them significant, especially on the regulatory front. All markets including many not mentioned here or in this series also have a history, innovations and developments.

As needed, we can discuss the other factors and markets in the future. But now, for our purposes, this brief …

6 Other investment choices

Making Investment Choices

This post on investment choices opens a continuing White Top View Series, Investment Choice. The series provides a basic survey of many choices for investors. The series begins with discussion of the most popular investment choices, mutual funds, ETFs and equities or stocks. The posts that follow that first group discuss less …

Investors Know The Wealth Builder Language: Accounting In The Spotlight

… Munger

Why Investors Know The Wealth Builder Language: Accounting in the Spotlight

Accounting is a universal language for businesses and investors to track financial activities. Effectively, it serves as a blueprint for building wealth, offering a clear view of income, expenses, and overall financial health. As a result, learning this language gives you a significant …

Practical Wealth Building Rules You Need to Know

… for decades. At that time he focused on industries he know well, like consumer goods and financial services. By sticking to businesses he understood, Buffett built a track record of success based on sound, informed decisions. His disciplined approach serves as a valuable example: if even the most seasoned investors recognize the importance of understanding

Read MoreExploring the Benefits of the Index-Plus Layered Portfolio

… into their investment approach. Consequently, this empowers them to make informed decisions and achieve financial goals.

Benefit 1: Investor Education Guide

The Index-Plus Layered Portfolio Strategy serves as a guide for investors to learn from. First, it provides step-by-step support to help users succeed. Additionally, it begins by giving new investors immediate …

Retirement Plan Essentials: How to Build Your Secure Retirement

… Planning Essentials. This approach ensures that you are guided and supported in writing your customized retirement plan. Mary’s personal journey, marked by financial betrayal and resilience, serves as a powerful reminder that taking control of our financial future requires careful planning and preparation. The guide covers a wide range of topics, from lifestyle choices …

Read More