Search Results for: Diversification

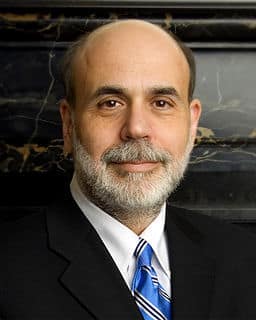

Amazing Story of the Man Who Cancelled an Economic Depression

… Lessons: Amazing Story of the Man Who Cancelled and Economic Depression

3 Yeses or no investment

6 Small investor advantages Warren Buffett knows

Smart investors use smart diversification

Market time grows money

Muddled minds harm investors

Shorting stocks has risks

4 Indicators muffle market noise

Nelson Mandela touched investors

Media exposes advisor incompetence

Comments and …

Lower Cost ETFs Can Boost Your Bottom Line Returns

… the past few decades for several reasons:

Diversification: An ETF is a collection of securities, often tracking a specific index, sector, or asset class. This built-in diversification spreads the risk across multiple assets rather than concentrated in a single stock. For many investors, this diversification offers a cushion against the volatility of individual securities …

FED Used Massive, Powerful Financial Stimulation to Obstruct A Depression

… trillion in play

Mortgage refinancing shifts back to capital markets

Other Lessons Related To: FED Used Massive, Powerful Financial Stimulation to Obstruct A Depression

How investors buy dips

9 Short seller facts

Smart investors use smart diversification

Warren Buffett explains gold

Oprah’s right – Aristotle got it wrong!

Momentum investing trading play

Short story …

Equities Explained: The Best No Worry Investor Wealth-Building Strategy

… higher returns over the long term. This growth potential is a significant draw for many investors, instilling a sense of optimism and hope in their investment decisions.

Diversification

Equities play a crucial role in a diversified portfolio, helping investors manage risk more effectively by spreading investments across various sectors, companies, and locations. This diversification strategy …

Profit, Loss, and Advisors FAQs: What You Need to Know for Security and Financial Growth

… alternatives6. New issue stuffing – earn fees but have poor returns7. Unauthorized trading8. Unauthorized profile changes9. Ignoring instructions10. Breach of promise11. Misappropriation – theft, fraud, and forgery12. Concentration – poor diversification13. Margin abuse – fees on margin, not investment total14. Not licensed or registered15. Insider trading16. Ponzi schemes17. Pump and dump schemes18. Selling unregistered securities

For any misconduct concerns …

Warren Buffett Explains Gold: Why It's a Poor Investment Choice

… of gold. Gold bugs do push rarity as a value of gold but it is always available. Gold also gets sold as fear and uncertainty insurance and diversification protecting against deflation and geopolitics. However, money used to buy gold falls into a deep unproductive sleep. And any amount of it is heavy, awkward, and difficult …

Read MoreInvestors Get Rich Slowly: A Wealth Builder Guide For You

… participation in the market, as investors know they can access their money relatively quickly. Furthermore, stock markets enable risk management through diversification, allowing investors to spread their investments across multiple companies and sectors, which helps reduce overall portfolio risk.

Stock Markets as Economic Indicators

In capitalism, stock markets act as key indicators of economic …

The 3 Yeses Formula: How to Know When to Invest Confidently

… company pay dividends?10. What is the market capitalization? 11. What are the revenues, earnings, and price-to-earnings ratios? 12. Does this stock fit my Smart Diversification plan? Be aware that this research may find a competitor or other sector that offers better investment opportunities.

What numbers should stock buyers check?

Wise investors research …

Avoiding Costly Investing Mistakes: Choose a Strategy with Better Returns

… these pitfalls using goal-oriented investment planning and good investment management. That includes never trying to time the market, keeping costs, including fees, low, and using smart diversification for good returns and minimum concerns.

How do I avoid investment mistakes?

No-worry investing principles help investors avoid the frustration and challenge that mistakes can bring …

Playing Small Investor Advantages: How to Achieve Better Returns

… on your bottom line. It must make you money.

For this discussion, about how small investor advantages can produce better returns, we set aside any consideration for diversification or safety. But just for now. We cover the why, how and where of diversification and safety in other lessons.

Warren Buffett Recognized The Small Investor Advantages …