All posts by Bryan Kelly

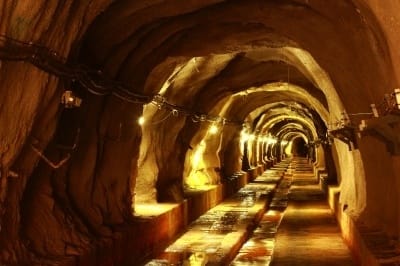

Bedrock of Toronto Stock Market

Investors ride rich rocks to build the TSX. Vast wealth comes from harvesting Canadian resources that built the nation and institutions across Canada. For investors, that includes the stock exchange now named the TSX that makes Toronto the dominating trading center for Canada.

Read MoreStock market promoter billions

Talk of Billions and Promoters – Promoters everywhere access the OTC and Grey Market. We have billions to discuss but first, just to get this out of the way; Canada does not have an OTC or Grey Market. Instead we borrow access from our friendly southern neighbor. You will recall that we covered those and the other US based markets in our discussions last week.

Read MoreCanada’s one trading place

Oh Canada One Trading Place Progress in communication technology and the digital age now sees Canadian stock or equity trading all centered and controlled from Toronto.

Read MoreAmerican OTC Stock Markets

Sorting American Stock Markets On the OTC Market you can buy stocks in about 10,000 mostly small companies or startup ventures from broker-dealers in the OTC Markets Group. So named as the Over The Counter market. Headquartered in New York but using a distinct operating model that spans the US.

Read MoreSorting US & Canadian Markets

Sorting Stock Markets of USA and Canada. An eight part series that looks at the stock markets novice investors need to know about in Sort through the stock markets of USA and Canada. At first look, finding and picking among the thousands of stocks for an investment, can seem daunting. The challenge becomes manageable by first learning which markets to consider. As important, we need to decide which markets we want to avoid. And we need to know why.

Read MoreExotic ETFs blow-up portfolios

EXOTIC ETFs – Caution Aggressive Investing Can Bite! ETFs beyond the basic ones should be be regarded as exotic, sophisticated and only for informed use in special situations. They should only be used by knowledgeable and experienced investors.

Read More3 Big investing choices

1 of 3 Big Investment Choices – Mutual Funds – The Costly Choice. Mutual Funds are pools of money contributed by many small unsophisticated investors. The funds are controlled and invested by professional managers. Financial dealers and banks create mutual funds as financial vehicles and offer numerous choices of every imaginable size. The investment focus of the fund can be on stocks, bonds or can be on other investments. Many companies offer combination funds. Every imaginable slice, dice and angle gets covered.

Read MoreETF Revolution changes investing

ETF Revolution Changes Investing History. Created two decades ago, Exchange Traded Funds or ETFs are a major innovation that began as a ripple and grew into a tidal wave. ETFs were listed on exchanges and trade like stocks. ETFs are essentially mutual funds created for the digital age. ETFs have costs, structure and fees all designed to provide investors with a very low cost alternative to mutual funds. These changes are shaking the fund business to its core with an ETF revolution changes investing history.

Read More6 Other investment choices

3 Big and 6 Other Investment Choices. The 3 big investment choices are: Mutual Funds, Exchange Traded Funds and Stocks plus 6 other popular choices. This post opens a continuing White Top View Series, Investment Choice. The series provides a basic survey of the many choices investors can access. The series begins with discussions of the most popular investment choices and the less common choices. Discussion of mutual funds, ETFs and equities or stocks opens the series. Additional posts discuss 6 other investment choices include, bonds, commodities, treasuries, money market funds, foreign exchange and derivatives. Options and futures are also parts of the investment mix for discussion.

Read MoreTop 4 Ways to find money to invest

Find the money to invest 4 ways, debt reduction, employer contribution, cost control, saving plan. Get rid of debt, employer contributions, cost control and savings.

Read More