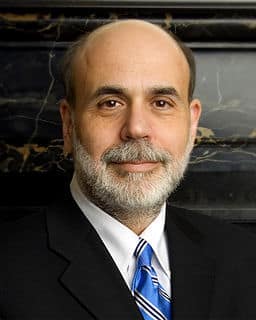

Former Federal Reserve Chair Ben Bernanke knows booming and busting as an expert on economics and the business cycle. As a result, investors benefited from his insights and strong management during the 2008 financial crisis. His studies of the earlier Great Depression and 20th century World Wars gave him important insights. Applying those economic stability and growth lessons, prevented another depression. Those actions protected the economy as well as wealth-building stock markets. It helped lower financial impacts during the crisis in the following and Great Recession.

What you learn from the lesson, Former FED Chair, Ben Bernanke knows booming & busting

The importance of FED leadership for investor success

Understanding the business cycle, recession, and depression

How Bernanke knows booming and busting and avoided a depression

How the FED response to the 2008 financial crisis helps investors

Investors ask FAQ about the FED and the economy

What does the FED do?

The Federal Reserve is the U.S. central bank that uses monetary policy to ensure a stable monetary and financial system to control inflation and support economic growth and prosperity.

That is done by adjusting interest rates, providing reserves to commercial banks, and conducting open market operations, typically purchasing securities that affect credit and mortgage markets.

A prosperous economy grows, and unemployment and inflation are low when everything goes well.

Why is the FED important?

The FED plays a vital role in regulating bank operations to ensure the safety and stability of the financial system. This economic cornerstone establishes monetary policy to promote prosperity, employment and maintain an efficient and dependable payment system.

Monetary policy activity includes setting interest rates, influencing the short-term market through Treasury trading, and adjusting bank reserve requirements.

That authority was expanded in the 2008 financial crisis when the Fed responded to long-term credit needs and force-fed the banking system.

The effects of these credit and investment responses will echo for years.

What makes good economic times happen?

Jobs play the most crucial role in creating a strong economy.

Employment provides cash flow and stability to families, instilling a sense of security in people. That combination makes people confident in their future, community, and the economy.

Confident consumers are more likely to spend and increase business revenues, further growing the economy.

What is the most important factor in economic growth?

Jobs are the most important of the many factors that impact economic growth. The combination of human resources and increasing worker productivity are the primary economic growth factors.

Productivity growth drivers are any increase in the workforce size, increased availability of technology, or increased specialization. However, specialization productivity growth is the producer of increased income.

It comes down to any increase in output value to the cost of labor input increases productivity and economic growth.

What causes a good economy?

Jobs and productivity are the most important economic growth factors. The other factors are population, capital, land, technology, innovation, and entrepreneurship.

Growth hinges on an expanded workforce and increased productivity, increasing per capita gross domestic product (GDP) and income, quickly showing as more consumer spending and business investment.

That can mean more capital investment, which with innovation, creates jobs and expands economies.

Governments can also stimulate economic expansion through regulatory, tax, and spending strategies.

Each factor affects the others, which stimulates a carousel of growth.

How does an economy grow?

The growth of an economy depends on several factors, including increased population, capital, land, technology, innovation, productivity, or entrepreneurship.

These factors contribute to the total value of goods and services produced within a country, the Gross Domestic Product (GDP).

However, an increased individual income only comes with higher productivity, which happens with capital investment, advanced technology, and workforce development.

What causes a financial crisis?

A financial crisis is a lack of confidence in the financial system.

Causes include extreme price reactions when there is a systematic manipulation, like the subprime mortgage crisis or a severe liquidity shortage.

But natural disasters, like hurricanes, earthquakes, tsunamis, or volcanic eruptions, can be a trigger.

Fear makes buyers and capital disappear, credit chills or freezes, and everything financial stops! Any short selling magnifies downside pressure, and depressive or inflationary forces loom.

Each time facts and circumstances change, but prices collapse or spike. So, governments, central banks, or The International Monetary Fund must act to impact banks, currencies, economies, and markets.

What is the business cycle?

The business cycle is the recurring pattern of expansion and contraction in economic activity. It tracks the changes in economic output, employment, income, and sales as population, interest rates, and spending increase or contract.

In an economic expansion, there is continuous growth in jobs, production, and sales until it peaks at maximum capacity. A slowdown often follows. That leads to a contraction, which reduces the size of the economy until it reaches the trough or a minimum stable level. Then, the economy recovers, and the subsequent expansion begins.

Economic behavior, management decisions, and government policies can influence the length of each phase in the cycle.

What is a recession?

Recessions are part of the economic cycle, occurring when economic activity declines for six months or more. They can happen with reduced consumer spending, less business investment, or government policy changes. These causes can decrease the Gross Domestic Product (GDP) and affect individuals, businesses, and governments.

As a result, business, demand, employment, output, income, industrial production, and sales all decline. That may also mean stock markets become volatile and fall as recessions vary in severity and duration.

In response, governments and central banks lower interest rates, increase government spending, provide financial assistance, and implement regulatory reforms to ease the impact of recessions and stimulate economic growth.

What is an economic depression?

An economic depression is a financial ice age with economic activity declining over 10% for three or more years.

A depression brings high unemployment rates, declining asset values, minimal inflation, reduced production, and low consumer confidence. People, companies, trading partners, and governments get financially cautious with a depression mindset of expecting lower prices. As a result, they minimize spending, which stagnates the economy.

Ending a depression takes revived economic activity and a new mindset. Doing that takes sustained bold financial expenditures, aggressive monetary policies, and strategic public initiatives over an extended period.

"How much would you pay to avoid a second Depression?"

Ben Bernanke

The financial crisis showed Bernanke knows booming and busting when depression loomed!

Investors can learn from history, cycles, repeating human behavior, and how change opens new ways forward. This lesson provides a quick look back to how Ben Bernanke knows booming and busting which prepared him to Chair the FED and deal with the financial crisis. His effective response as FED Chair avoided depression and kept markets functioning. And it marks the discovery of a new FED superpower!

As importantly, his actions also opened the door to new future possibilities for capitalistic economies. Those possibilities include an economic future with more growth and prosperity while also improving security and stability.

Bernanke knows booming & busting in a snapshot

Ben Bernanke was appointed as the Federal Reserve's Chair in 2006 and served until 2014. During his time as Chair, he oversaw the Fed's response to the 2008 financial crisis. This included implementing aggressive monetary policies, such as quantitative easing, to help stabilize the economy and prevent a full-blown depression. Bernanke's actions were widely praised for their success in preventing another Great Depression.

Back to the business cycle and stimulus intervention

Throughout the history of the world, the business cycle endlessly repeated through booms and busts. But Ben Bernanke discovered there are other possibilities! He used his awareness of the power and positive benefits of huge government spending. That insight changed everything. His actions removed the most severe effects from the downside phase of the endless boom and bust cycle.

As a result, everyone including investors benefited because Ben Bernanke understands a way to manage the cycles of booms and busts that began at the dawn of time. He saw a way to bring the resulting chaos under control. The difference was, Ben Bernanke knows and understands the power of stimulus.

About our economy superhero, Ben Bernanke!

Ben Bernanke, the former chair of the Federal Reserve, is one of the most important economists of our time. He has a PhD in economics from MIT. As well, he and spent more than a decade teaching at Princeton University.

Until his generation of economists, that matured studying the Great Depression and World Wars of the 20th century, things were different. Previously, the understanding of booms and busts remained fairly primitive. The economists of previous eras knew about business cycles. But they didn’t understand their cause or how to fix them. In fact, at that time, many economic thinkers thought that depressions were a necessary part of a healthy economy!

But it was Ben Bernanke's work on the Great Depression that made him famous. In 2002, he published a book called “The Great Depression.” This book not only shows how he studied our economic past, but also provides important lessons for the future. In it, Bernanke argues that bad policy decisions worsened and lengthened the Great Depression. That knowledge provided him with essential insights that saved us from living through a depression.

The economic crisis of 2008 was a turning point in Ben Bernanke's tenure as Federal Reserve chairman. He used quantitative easing as his major economic power tool. With it, he injected the economy with round after round of funding. It was the beginning of Quantitative easing, FED speak for the creation and forcing massive amounts of money into the economy.

As well, by effectively lowering interest rates to almost zero, borrowing money became all but free! With such bold moves, Ben Bernanke contributed to keeping unemployment from rising above 8 percent. Although much financial pain remained, the FED and U.S. Treasury won the fight. They powerfully supported the economy. Credit thawed, an economic crash was avoided, and risks of depression were contained by these economic heros.

Repeating that business cycle

To understand the business cycle, imagine we have a product that fills a need or finds a market. For the sake of our story, say we have a great hit! As a result, our enterprise grows! But, we can’t make enough to meet demand! Even at our high and very profitable prices, there is still more wanted. We must make still more!

We hire more help and expand capacity again and again. The money pours in! Each expansion follows more expansion as production grows and grows! And more good times roll!

But eventually, we saturate the market. By filled and now exceed the need, so things slow down. With needs met, people buy no more. Even at lower prices, we don't sell anything at all!

The boom ends and we enter a bust phase. Soon, the market moves on as the need has been filled. From growth to decline, all is normal. This is the story of business cycles that go from boom to bust. Through our economic history that cycle has been endlessly repeated. In fact it has happened throughout the economic history of the world. The place, time, and product or service may differ, but it has always been so.

Times thousands of buyers and sellers - a bust!

Multiplying the effects of our imaginary enterprise across many thousands of other producers. And their suppliers as well. The slowdown produces the bust. Sometimes, individuals or businesses learn to fight back. They try by offering more service or at lower prices. But doing something more, or lower prices can rescue some business. Or it may just prolong the struggle. But, for some over time, they might expand their operations to gain even greater profits.

The business cycle began with the first market in history

Our imaginary company just went through the business cycle. That economic pattern began from the time humans first began exchanging goods and services. It has been part of all markets and economies.

The business cycle is the periodic fluctuations in economic activity that occur over time. Businesses go through ups and downs as they respond to changing market conditions. And these fluctuations in turn cause the economy as a whole to experience periods of growth and contraction.

Although the business cycle has been occurring for centuries, only now, Bernanke had a response that could stop an economic decline! Could it be he discovered there was a way to control the bottom of the business cycle?

The business cycle across the economy

Our story was about one imaginary company, but the business cycle pattern applies across an economy. That impacts all companies and people in that economy. It begins with expansion, the continually growing production as businesses prosper.

The boom is on! That booming growth continues until it meets demand. But, most times, more production keeps piling on. As a result, prices are forced down. And that eventually stops further expansion. Most times we race to increase production until it gets overdone.

But with too much production in place, price declines bring on a recession or economic slowdown. When unchecked, the now excess production pressures prices down until a depression or broad contraction of the economy begins.

Through depressions, prices continue to steadily decline. In time, the price decline does bottom or form a trough with stable low prices. Then recovery can begin. Recovery can develop into another expansion. And, just as it has through economic history, without intervention, that endless cycle continues.

Stimulus lessons of 20th-century wars and the economy

Ben Bernanke was different. He studied how to manage an economy through business cycles and learned lessons from the destructive wars and depression of the 20th century. He knew and understood that there were lessons in that destruction and loss. As a result, he was able to use a crisis to produce stability and prosperity.

The massive investments in war materials during war and funding for recovery following war was a massive injection of economic stimulation. For example, World War I spending and recovery were investments that helped drive the Roaring Twenties. That was a decade of tremendous job and economic growth. Good times!

Those good times got overdone and peaked with the 1929 stock market crash. That triggered a sudden downturn that opened the way to the worst depression in history. At the time, the FED acted but, as Bernanke discovered, they took the wrong action and actually prolonged the depression. They supported gold rather than the economy or people!

At that time, the FED and Congress got it wrong. The struggle of the Great Depression only ended when another war loomed. The material and production for war and the recovery from that human disaster actually ushered in decades of growth that benefited millions. Bernanke understood economic stimulus was a powerful tool.

One huge positive that came from the massive destruction of total war. That was valuable economic lessons. Although World War I and World War II cost many millions of lives they proved to be huge economic simulators.

Investors can see patterns emerge, when massive stimulus drives the economy, stock markets do well. But, when economies contract due to bad policy or external shocks, stocks usually do badly. The prosperity and economic expansion of the 1950s and 1960s directly flowed from massive government stimulus. That stimulus provided funding for rebuilding and expanding infrastructure.

FED identifies a superpowered economic depression risk remover!

But change was on the way with the FED response to the economic threat. Our hero, then FED Chair, the brilliant Ben Bernanke, had knowledge of economic and FED history as well as a plan, and showed the leadership needed to invent and use massive stimulus, his new FED economic depression risk remover!

Allied with strong U.S. Treasury support as well as essential political backing, he quickly made his brilliant moves. Overnight, a credit freeze was thawed, the economy on the edge did not jump, and reassured stock markets opened.

Until these innovative FED actions, there has never been a way to eliminate the risk of depression from an economy. But economic superhero, Ben Bernanke, did it!

For the first time in world history, an economic depression risk was contained. That is certainly a significant event in the history of money and economies. This new toolbox invention changed the future possibilities for central banks and capitalist economies.

Recap Bernanke knows booming and busting

With his courageous leadership, Ben Bernanke made economic history and avoided another depression! The massive stimulus program surprised many but was the right way to thaw a credit freeze, loosen a stalled economy, and got frightened markets functioning again. With Presidential support, cooperation from, Congress and the U.S. Treasury, the world was pulled by from the edge of an economic disaster.

We got on with the business of growing the economy needed for stability and prosperity. But things had changed, huge and continuous streams of government funding poured into the market. That increased GDP reduced unemployment, financed social programs, supporting infrastructure, and kept credit working. Not only does Bernanke know booming and busting, he knows how to tame it!

Takeaways from Bernanke knows booming & busting

Quality informed FED leadership is essential for investor success

The Business Cycle repeats economic expansion (boom) and contraction (bust) caused by demand fluctuations from changes in population, interest rates, and spending.

A recession is a decline in growth.

Depression is an economic decline.

Ben Bernanke knows booming and busting from his study the economic impacts of the Great Depression and World Wars.

Bernanke's knowledge and leadership skills helped him lead the FED, markets, and economy when a financial crisis threatened a depression.

The FED successfully managed the 2008 financial crisis.

Share: Bernanke knows booming and busting

Buttons at the bottom of the page let you send this lesson to family and friends!

Subscribe free and get White Top Investor lessons in your inbox!

Make money work for you by knowing how investors think, feel and act. Learn here The Investor Mind.

White Top Investor website layout and organization: click here.

Course links to White Top Investor lessons.

You may also like these other lessons related to: Bernanke knows booming and busting

6 Small investor advantages Warren Buffett knows

Smart investors use smart diversification

4 Indicators muffle market noise

Nelson Mandela touched investors

Media exposes advisor incompetence

Comments and questions welcome

Email me at [email protected].

Make money work for you

Use White Top Investor lessons to learn investing. By doing that you can grow into a knowledgeable, comfortable and confident investor. To learn how, you can learn investing one small step at a time at your own pace. Do that and become the master of your financial security and independence. White top Investor never sells or shares our email list. Learn more.

Movers & Shakers Of Stock Markets,Lesson links:

Influencers that move markets Lesson 1

Understanding banks and credit Lesson 2

People, places and parts make markets Lesson 3

Invention builds banking power Lesson 4

Mortal investors see immortal debt Lesson 5

Markets spark interest in interest Lesson 6

Financial crisis lessons learned Lesson 7

Bernanke knows booming and busting Lesson 8

Cryptocurrency considerations Lesson 9

Internet money in a digital future Lesson 10

Analyzing analysts, data and investments Lesson 11

Next course: Choices To Make Money Work

Have a prosperous investor day!

Bryan

White Top Investor

[email protected] WhiteTopInvestor.com

Let’s connect, follow me; Twitter LinkedIn Facebook

Images courtesy of U.S. Government and FreeDigitalPhotos.net

Lesson code: 335.05.

Copyright © 2011-24 Bryan Kelly

White Top Investor