All posts by Bryan Kelly

Stock scam awareness defense

Defense Against Stock Scams covers a $140 million stock scam from August, 2013. A reminder that awareness and homework are the best defense against scams. This post begins the White Top View Series, Scam Defense. Part 2: 4 tips make an easy stock scam check follows as our next post. Stock scamming crooks duped investors out of $140,000,000! Hundreds of victims in 35 countries were scammed by four Canadian sleazebags. They were assisted by five American stock crooks. So far 7 have been arrested.

Read MoreInvestors use many stock market strategies

Investors can ride growth stocks with traders. Strategies differ, but income seekers can join traders seeking gain by riding growth stock opportunities. Both income and equity growth seekers can find growth stocks that produce results.

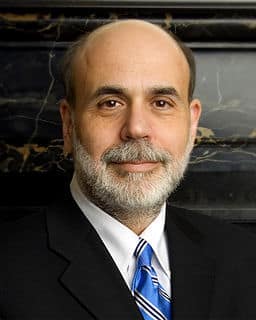

Read MoreFormer FED Chair, Ben Bernanke knows booming & busting

Fed Chairman Ben Bernanke has the answer: From the dawn of time the business cycle has boomed and busted. For any product or service we humans endlessly seemed destined to repeat the same pattern. Be it a company or economy we cycled endlessly through extremes of expansion and contraction.

Consider the possibility that Ben Bernanke knows the way to smooth this cycle and put prospects of greater prosperity back on the table.

Investors ask about short selling

Investors ask about short selling in these FAQ from the short story shorting stocks course on the impact short selling has on investors and markets. The Introduction to short story shorting stocks course explains the short sale process and how it impacts markets, investors, investing, and companies. Investors ask many questions about what is short […]

Read MoreBuying ETFs accelerates returns

Mutual fund investors can switch to buying ETFs and boost their bottom line. That happens because EFTs have much lower costs for sales and management. Those cost savings happen because ETFs are designed for the technical efficiency of modern markets. In contrast, mutual funds were designed for a long gone era. Their outdated design, old management organization, and obsolete sales structure has high costs. And those costs come from investor pockets. As a result, investors switching to ETFs give themselves a very nice bottom line boost!

Read More5 Secrets of No-Worry Investors

5 Secrets of no-worry investors are setting goals, acquiring knowledge, making decisions, being patient, and minimizing risks and costs. Some no-worry investors manage their own portfolios, while others use the services of professional advisors. But all no-worry investors produce excellent long-term investment results! And you too can succeed by learning and following no-worry investing!

Read MoreFED billions bounced depression

FED billions bounced depression possibilities in 2008 to save the world economy! Doing that was FED Superhero Ben Bernanke, then US central bank Chair. He used massive Quantitative Easing (QE) or massive long-term financial stimulation to bounce the depression monster!

Read MoreEquities the 3rd investment choice

Equities the 3rd Big Investment Choice. The 3rd big investing choice in the public markets are equities or stocks. This continues the White Top View Series, Investment Choice. Knowing makes investing easy. For best results in equities we need to develop the knowledge and understanding to avoid and manage risks. That enables us to safely position ourselves in favorable situations with the best upside prospects.

Read MoreFAQs about financial advisors, analysts, and investor’s profits

FAQs about financial and investment advisors that investors asked are listed here with brief answers and links to related lessons for more details, discussion, and FAQs related to stock market investing topics. The listed questions and answers are all from lessons in the White Top Investor course, Investment Choices of Superior Investors.

Read MoreIntroducing high frequency trading explained

Introducing high frequency trading explained, gives an overview of this course that explains how computers and the latest technology get used to generate huge trading volumes to rig stock markets. Those great volumes, traded at blazing speeds, change markets trading shares, commodities, options and currencies. Course lessons explore those changes, how they came about and how they impact the wealth of every investor.

Read More